With the rapid growth of energy storage demand, the world will usher in a new stage of home energy storage explosion in 2022, with a tenfold increase in penetration rate! Because of energy storage technology mature and cost down, high-speed growth energy storage started in 2021, in 2022 because of Europe's energy cost and electricity price rise year by year, the superposition between Russia and Ukraine war and overseas large-scale blackout, high residential electricity cost + power supply stability, bring home photovoltaic system demand, then bring home energy storage market more than expected.

Driven by European policy & economy, home energy storage has exploded, and American home energy storage has grown rapidly. European home energy storage capacity shows explosive growth, in which Germany is the world's largest household store market, this year the German residential electricity reached more than 60 euro cents/KWH, relatively early in 2021, three times in photovoltaic energy storage system of capital is recovered in 7-8 years, if consider countries such as tax breaks or direct subsidy policy, investment payback period will be further reduced to 2 to 3 years. (Source: Think Tank for the Future)

Italy, Poland, the United Kingdom, the Czech Republic and other countries in Europe are also accelerating growth. We expect that the installed capacity of home energy storage in Europe will reach 10/23 GWH in 2022/2023, with an increase of 378%/133%. China's battery and inverter enterprises are highly recognized in Europe, fully benefiting from the explosion of demand for home energy storage in Europe! Local dealers and installers have also benefited greatly. In the United States, the electricity price is high and the power supply system is poor. Based on self-use and peak-valley arbitrage to save electricity bills, the demand for household energy storage is growing rapidly. The U.S. home energy storage market focuses on local brands (Tesla /Enphase, etc.), and Chinese companies are gradually penetrating into industrial, commercial and ground energy storage. China's household energy storage economy is not high, but the local implementation of mandatory supporting energy storage policies, and the industrial and commercial peak-valley electricity price gap is widening, distributed energy storage is expected to gradually increase.

Home energy storage new track, the world ushered in the acceleration period

1.Home energy storage: The core is a photovoltaic energy storage system with battery + energy storage inverter

Home energy storage is a necessary adjunct to distributed energy systems. Energy storage can be divided into 5 sides according to application scenarios as below:

(1)User side (spontaneous self-use and peak-valley spread arbitrage)

(2)Generation side (grid connection of renewable energy and reduction of light and wind abandonment)

(3) Power grid side (power peak regulation and frequency modulation)

(4) Transmission and distribution side;

(5) Auxiliary services (standby power source of 5G base station)

The core of household photovoltaic energy storage system is photovoltaic + battery + energy storage inverter. Household energy storage and household photovoltaic are combined to form a household photovoltaic energy storage system. The photovoltaic energy storage system mainly includes a battery, energy storage inverter (bidirectional converter), component system and other parts. A typical system is 5KW (component + inverter) with 10KWH (energy storage battery) or 10KW+10KWH, in which the battery is the core of the energy storage system. Cost accounts for about 45-50%; Energy storage converter can control the charge and discharge, AC and DC conversion, the cost of about 10-15%; Module systems, or photovoltaic systems, are used for solar power generation, accounting for about 20-25% of the cost; The installation cost increased from 2,000 usd in 2021 to about 4,000 usd, accounting for 15-20%.

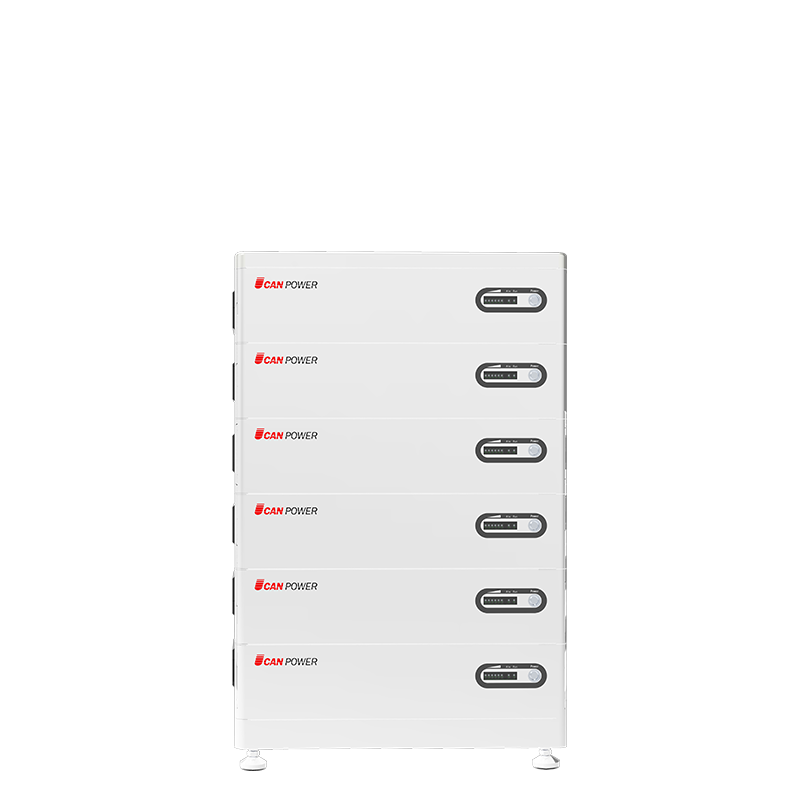

2. Product series: Household energy storage products are divided into All-in-one HESS system and separate machine (separate HESS system)

Household energy storage system products include all-in-one and split-type. 1) All-in-one machine: family-type photovoltaic energy storage inverter is an integrated system that puts the photovoltaic inverter, battery and controller in the interior, and displays the working state conveniently, quickly and intuitively through the touch screen. Parameters can be modified and a variety of working modes can be used for convenience. Generally, there are three working modes: solar energy priority mode, AC (mains) priority mode and SE priority mode (staggered peak power consumption mode). 2) Split type (inverter + battery system): the battery of household splitter is installed separately from the inverter. Users can match the household energy storage inverse transformer according to their own needs. In addition, switching power supply or inverter can be used as backup power supply. Generally, it includes four types: hybrid home photovoltaic + energy storage system, coupled home photovoltaic + energy storage system, off-grid home photovoltaic + energy storage system, and photovoltaic energy storage energy management system.

3. Technical route: LiFePO4(Lithium iron phosphate) battery is the mainstream route

The mainstream technological route of household energy storage is LiFePO4 (lithium iron phosphate), while sodium ion and Lithium manganese iron are new paths in the future. Energy storage battery technology routes including lithium ion batteries, lead-acid batteries, VRB (fluid flow battery) etc., the current lithium iron phosphate lithium battery with high safety, long cycle life and other characteristics, compared with the ternary lithium battery, more in line with the design requirements of the energy storage electric pool, is the mainstream of the energy storage battery development route, tesla energy storage battery also gradually from three yuan route to lithium iron line. In addition, some companies, such as CATL, UPOWER and PaylonTech, have been conducting research and development and testing of sodium ion and lithium ferromanganese batteries. We expect that the technological route of energy storage batteries in the future is expected to be further improved.

4.Industry barriers: product design and channel construction.

The core barrier of household energy storage lies in its adaptation and channel advantage with energy storage inverter. As a small energy storage battery, the integrated core technology requirements are not high, and its core competitiveness is product design and market development (the key is market brand and channel construction).

1) Product design: Primarily with energy storage inverter adapter (countries/regions have different requirements) and based on customer demand for customized product design, for example, the BMS and energy storage flywheel inverter need adapter, dc inverter controller through the CAN interface with BMS communication, access to battery status information, which CAN realize for protection of the battery charge and discharge, ensure that the battery runs safely.

2) channel construction: according to the research of PV magazine, when consumer is buying energy storage battery to consider one of the biggest factors is brand reputation, consumer will seldom know that used batteries and a source of spare parts, and overseas channels certification cycle complex and long, energy storage manufacturers and downstream integration, installation of channel construction and maintenance is particularly important.

5. Business model: Multiple sales methods coexist, brand and channel construction advantages

Sales model includes direct selling and distribution, brand and channel building advantages. The sales modes of three types of players in the household energy storage industry chain are as follows: 1) Cell/energy storage inverter suppliers: It is divided into To C and To B. To C generally integrates the home storage system, establishes its own channels and promotes its own brand, and has certain consumption attributes. To B is a general product supplier, sells products To integrators, does not have consumption attributes, and earns material costs and processing fees.

6. Pricing model: Home energy storage is more expensive abroad and is highly profitable per watt hour.

The price difference of household energy storage at home and abroad is the largest, which is higher than that of industrial and commercial energy storage and MW class energy storage, and it is nearly 133% higher in foreign countries than that in China (based on the highest price). The CIF quotation is the main price, and the seller bears the main risk. At present, the domestic price of household storage products within 30kWH is 0.20-0.30 usd/Wh, and the foreign price is 0.30-0.40 usd/Wh, which includes the cell, BMS and shell, and the 10-year warranty of wiring harnesses. There are four kinds of quotation: EXW, FOB, CIF and DDP. The quotation consists of price of goods, parts and FOB/CIF/DDP etc. At present CIF offer is in the majority, the seller undertakes higher risk.

7. Volume of demand: With the rapid growth of demand, the world is ushering in an accelerated period of household energy storage.

The demand for household energy storage is growing at a high rate, with a year-on-year growth of 56% in 2021. According to BNEF data, the global installed capacity of energy storage in 2021 is about 10GW/22GWh, up 84%/105% year-on-year, among which the installed capacity of distributed energy storage is about 2.5GW/5.6GWh, up 45%/40% year-on-year, and the installed capacity of distributed energy storage is about 1.9GW/4.4GWh. With a year-on-year growth of about 53%/56%, global household energy storage market is booming. The main driving factors come from two aspects: one is the continuous increase of policy support, the other is the economic drive of high yield. (Source: Think Tank for the Future)

High cost-performance driven, household energy storage demand is overwhelming.

1. Reason one: The cost of electricity is high and continues to rise

Energy crisis, overseas electricity costs are rising. In recent years, the electricity price of European and American countries has been rising year by year, and affected by the Russia-Ukraine conflict and other events, the natural gas cost has soared, and the electricity price has risen rapidly in the short term. The average price in the European spot market has risen from about 50 euros /MWh at the end of 2019 to over 300 euros /MWh at the highest. Across Europe, electricity prices in May 2022 were 100-330% higher than at the beginning of 2021. According to ING forecasts, underlying energy prices in European economies such as France, Germany, Belgium and the Netherlands will remain high at around 150-170 EUR /MWh throughout 2022.

2. Reason two: The power grid coordination capability is weak and the power supply reliability is insufficient.

Overseas is affected by extreme weather + power grid coordination ability is weak, and residential power supply stability is poor. In recent years, various large-scale power outages broke out overseas. In 2021, the power grid system of the United States was relatively old, and Texas was affected by a cold snap. Moreover, the system of each state was relatively independent and difficult to coordinate, which affected 5.5 million households in the United States, including more than 2.5 million in Texas. According to the EIA, the average customer in the U.S. spent 492 hours without power in 2020, with 373 hours due to severe weather and emergencies. In 2022, a power plant accident occurred in Taiwan, affecting 5.49 million households and losing 10.5 million kilowatts, accounting for about one third of the power supply in Taiwan. Household storage can provide emergency power supply in case of power plant accidents or extreme natural disasters to improve the stability of electricity consumption.

3. Reason three: Policy support such as tax reduction and exemption is gradually implemented.

Overseas countries introduced tax breaks or direct subsidies and other policies to promote development. Related policies can be mainly divided into two categories. One is to implement relevant tax reduction. For example, Italy increases the tax reduction of home storage equipment to 110%, and the United States will give investment tax reduction of up to 30% for energy storage systems higher than 5kWh by 2026. The other is financial subsidies, such as 66% of the cost of installing lithium-ion batteries in households and businesses in Japan, and €500 ($550) for each 3kWh or more storage system in Bavaria, Germany.

4. Reason four: high yield, short payback period.

The yield of household storage is relatively high, and the yield can reach more than 15% without considering the subsidy. The payback period is within 6-9 years. Germany, the United States and other countries at the forefront of the development of household energy storage in the world have a high rate of return due to their high electricity price. 1) Take Germany as an example, assuming that the scale is 5KW, the storage is 50%*2h, and the cost of household photovoltaic + energy storage is 2.06 euros /W. The IRR is 22.55% based on the retail price of 0.4 euro /KWh and the feed-in price of 0.06 euro /KWh. 2) Taking California as an example, assuming a scale of 5KW, 30%*4h distribution and storage, household photovoltaic + energy storage cost is $4.63 /W, IRR reaches 18.9% based on the peak electricity price of $0.6 /KWh and the average electricity price of $0.23 /KWh. With the decrease of system cost and the increase of electricity price, IRR will be further increased. Overseas high yield, short payback period to stimulate the rapid development of household storage.

5. Reason five: The on-grid price is lower than the electricity price.

On-Grid household photovoltaic electricity price policy gradually shifted to self-consumption, and residents were encouraged to configure energy storage on the basis of photovoltaic. At present, on-grid household PV electricity price mainly includes feed-in tariff policy (FiT), net metering and self-consumption. In Germany, Japan, Australia and other countries, the subsidy price of FiT has been declining in recent years. In Germany, the feed-in tariff of surplus FiT electricity has decreased by more than 80% in the past 15 years. In Japan, the subsidy price of household PV FiT will expire in November 2019. At present, some states in the United States have terminated the net measurement plan, the Netherlands, Italy and other countries will also withdraw from the net measurement policy. Under the self-consumption mode in Germany, the on-grid price is only 0.06 euro/KWH, while the self-use part is equivalent to the profit of 0.4 euro/KWH. Therefore, the self-use after distribution and storage can improve the yield. While the FiT and net metering policies are gradually declining, the self-consumption policy is gradually promoted, and the economy of residents' light distribution and storage continues to improve.

6. Conclusion: photovoltaic energy storage economy is improved.

The gap between LCOE of photovoltaic energy storage and household electricity cost is widening, and the economy of household photovoltaic energy storage is prominent. According to the SPE, the average cost per kWh (LCOE) of PV + energy storage equipment in Germany was 14.7 euro cents per kWh in 2021, close to 1/2 of the household electricity price in the same period, with an LCOE difference of 17.2 euro cents per kWh. We expect that the price difference between the two will continue to increase gradually. By 2023, the LCOE of light + storage is expected to decrease to 12.8 Euro cents /kWh, and the LCOE gap with household electricity price will increase to 18.9 Euro cents /kWh in the same period, and the economy of household electricity storage will be further highlighted.

European household energy storage market exploded; the United States market accelerated growth

1. Europe: The household energy storage market is growing rapidly, with Germany leading the European market.

In 2021, European household energy storage capacity reached 2,045mWh, with a year-on-year growth rate of 73%. The compound annual growth rate from 15 to 21 reached 63%, with a very fast growth rate. Among them, Germany is the biggest driving force for the growth of European household storage capacity. Italy (191MWh), Britain (81MWh), Spain (48MWh) and France (35MWh) followed, with CR5 accounting for 90 percent of the total.

2. Germany: The largest home energy storage market in the world, with the continuous growth of home energy storage installations.

Germany is the world's largest market for household energy storage, with the world's largest installed penetration rate of photovoltaic energy storage. In 2021, Germany added 1.48GWh of household energy storage, an increase of 45%, accounting for 34% of the global total; The cumulative installed capacity is 3.92GWh, an increase of 60.6%, accounting for 32% of the global total. The penetration rate of photovoltaic energy storage in Germany was 3.6% in 2021, ranking first in the world. Under the energy crisis, the price of electricity rises, which stimulates the high demand of household energy storage. Average wholesale electricity prices in Germany rose to a maximum of EUR 206 /MWh in June 2022 from EUR 52.8 /MWh in January 2021, an increase of 313%.

3. Italy, UK, Austria: The household energy storage market is growing steadily.

High electricity prices and policy subsidies drive the development of the residential energy storage market. In addition to Germany, Italy, the United Kingdom and Austria, which are among the top countries in the scale of installed household storage capacity, have seen a steady increase in the scale of newly installed household storage capacity every year driven by electricity price and policies. By the end of 2021, the installed scale of household energy storage in the UK was 81MWh, with a year-on-year growth of 113%. Italy ranked second only to Germany in the European region in the amount of household energy storage installed. In 2021, Italy installed 191MWh of household energy storage, with a year-on-year increase of 122%.

4. United States: Energy storage market space is huge, household energy storage accelerated development.

Energy storage in the U.S. is on a fast track. The cost of energy storage systems in the United States continues to fall, policy support continues to increase, and federal and state regulatory reforms have led to rapid growth in the United States. In 2021, the newly installed capacity of energy storage in the United States was 3971MW/10880MWh, with a year-on-year growth rate of 341%. Among them, household energy storage is newly increased by 343MW/960MWh, accounting for 8.8% of the total newly installed energy storage capacity. According to the Energy Storage Association, the U.S. market for deployed energy storage will grow fivefold by 2025. Of these, user-side energy storage systems continue to make up the bulk of this growth.

5. China: Currently, the economy of household energy storage is not high, and manufacturers of household energy storage mainly target overseas customers.

The installed capacity of energy storage in China is growing rapidly, mainly from centralized installations. China's installed energy storage capacity has been growing rapidly in the past two years. In 2020, the newly installed energy storage capacity reached 1.37GW/2.48GWh, with a year-on-year growth of 153%/189%. In 2021, the newly installed energy storage capacity reached 2.45GW/4.61GWh, with a year-on-year growth of 79%/86%. Distributed energy storage in China is still in the initial stage of development with low economic efficiency. The installed capacity of distributed energy storage in 2021 is 188MW/333MWh, with +11%/-30% year-on-year, and concentrated energy storage accounts for more than 90%.

6. Australia: Policy support, lighting and installation conditions driving residential energy storage Market development.

Policy support, better lighting and installation conditions drive the development of household energy storage market. In terms of policy support, Australia has introduced small-scale renewable energy schemes and FiT subsidy policies to promote light storage and installation; In terms of illumination and installation conditions, Australia has abundant illumination resources, high efficiency of photovoltaic power generation, large land area and sparse population. Most of the houses are villas, which are suitable for photovoltaic installation and high economy of home storage system. In 2021, Australia achieved 206MW/494MWh of household storage capacity, up 45% year on year in terms of MWh caliber.

7. Japan: The subsidy is downhill, the power supply is unstable, and the housing type is suitable to drive the development of household energy storage

Japan has a higher penetration rate of household energy storage, second only to Germany. In 2021, the installed amount of post-meter energy storage in Japan was 931MWh (+8% year on year), and household energy storage accounted for 90% of the post-meter energy storage. According to Infolink survey statistics, there are more than 25 million houses suitable for PV installation in Japan. By 2020, the ratio of installed PV and energy storage is about 10%/2%. Even in Japan, where the development of household PV is relatively mature, there is still a lot of room for expansion in the future. We expect 38.5% penetration by 2025. (Source: Upower HESS Data Center)

+86-755-28263405

+86-755-28263405

info@ucanpower.com

info@ucanpower.com

4th Floor, Building A, Huafeng Zhigu-Yuanshan Science and Technology Park, No. 72 Yinhe Road, Longgang District, Shenzhen,CHINA

4th Floor, Building A, Huafeng Zhigu-Yuanshan Science and Technology Park, No. 72 Yinhe Road, Longgang District, Shenzhen,CHINA

+49 (0) 170 4910717

+49 (0) 170 4910717

UcanPower.de@ucanpower.com

UcanPower.de@ucanpower.com

Hinter dem Turme 15,38114 Braunschweig. Germany

Hinter dem Turme 15,38114 Braunschweig. Germany